Episode 53 - Flowers

The Flower Industry

Four different types of products are sold in the flower industry: cut flowers, foliage, plants, and young plant material. This episode focuses on cut flowers.

The Demand for Cut Flowers

The cut flower industry is worth $100 billion worldwide. 60% of flowers are bought as a gift and another 20% are for weddings or funerals. Flowers Canada did a Consumer Research Study, which found that the two gifts millennial women most appreciate are wine and flowers.

How It Works

Flowers are grown, cut and packed on flower farms. Then they either go to a flower auction or through the direct flower trade. Florists buy flowers either through auctions or directly to wholesalers.

This short video shows what Dutch flower auction houses look like. 40% of the world’s imported flowers pass through auction houses in the Netherlands.[1] Fun fact: North America’s largest flower auction house is in Burnaby, British Columbia!

Cut flowers are typically shipped by plane, unless they are grown locally. For example, around 187,000 tons of flowers go through the Miami International Airport every year.

Globalization and the Cut Flowers Industry

Since the 1990s there has been a shift in production from Europe and North America to developing countries with warmer climates and cheaper labour. The four biggest cut flower exporters are: the Netherlands (55%), Colombia (18%), Ecuador (15%), and Kenya (15%).

The U.S. imports almost 80% of their flowers. Most flowers sold in the U.S. come from Colombia and Ecuador. Two out of every three flowers in the U.S. are imported from Colombia. In Canada, 55% of imported cut flowers are from Colombia, with 26% from Ecuador.[2]

Countries do specialize in certain flower varieties. Here is a list with the top global producer for a few flower varieties:

Rose: Ecuador

Tulip: The Netherlands

Carnation: Colombia

Orchid: Thailand

Peony: The Netherlands

The Rise of Supermarket Flowers

75% of the cut flowers market is made up of online retailers and supermarkets. Supermarkets tend to buy lower quality flowers than high-end florists. But they do demand a great deal of uniformity and may require some form of environmental and/or social standards in their supplier codes.

Which is better: supermarket or florist? It’s hard to say across the board. Supermarkets will adopt standards as a risk reduction strategy, whereas florists are drawn to certification either to differentiate themselves or out of a general feeling of responsibility. But most florists (at least in Europe in 2011) are not actively engaged in social and environmental standards as a purchasing criterion or in communication to customers.

Workers’ Rights

As is common with agricultural products (see our episodes on tea and chocolate, for example), flower farm workers in developing countries generally receive low wages and their working conditions are not comfortable. Union busting is common practice in some countries and can be violent.

There are a few workers’ rights issues that are particular to the flower industry.

Special events drive the cut flower industry, especially Valentine’s Day, Christmas, Mother’s Day, and weddings. 77% of flower purchases involve a specific occasion. Because the industry is so heavily event-based, flower farms need a lot of labour in very short time windows. In places with less mechanization and weak labour protections, that means flower workers often have to work very long shifts around key holidays.

Another problem that is especially prominent in the flower industry is worker safety. Specifically, flower workers can be exposed to toxic chemicals without proper protective equipment. Because flowers aren’t consumed, flower growers are allowed to use more pesticides than food farmers.[3] Approximately one-fifth of the chemicals used in the flower industry in developing countries are banned or untested in the US. Without proper protective equipment, farm workers exposed to toxic pesticides can become sick and, in some cases, die.

Sexual assault and harassment have been well-documented in the flower industry in Colombia and Kenya. Like the tea industry, there are a lot of women working in flower farming because they are perceived as being better at handling the plants delicately. In Kenya, for example, there have been accounts of sexual assault as a regular practice and in some cases as a condition of hiring and promotion.

Environment

Transportation

Timing is crucial for the cut flower industry. 45% of flowers die before they are sold. Typically, the time from harvest to sale is 10-12 days. And it is important to keep flowers refrigerated throughout this period, so they don’t spoil. For that reason, cut flowers are transported primarily by air. Of course, this means that transport contributes significantly to the environmental footprint of cut flowers.

That is why some people suggest that consumers think about plant miles – i.e.: how far did the plant travel to get to you?

Greenhouses

However, the fact that flowers are transported by plane does not necessarily mean that it is always better to buy local, from an emissions standpoint.

That is because it takes a lot of energy to heat greenhouses to the temperatures necessary to cultivate flowers in cold places like Canada, the United Kingdom, and the Netherlands.

A life cycle assessment commissioned by Fairtrade International found that “greenhouse gas emissions from air transport of roses from overseas are four to six times lower than those from heating the greenhouses in the Netherlands.” That study looked at the environmental impact of getting roses to Switzerland. So even though obviously the Netherlands is much closer to Switzerland than Kenya, Kenyan roses had a smaller carbon footprint.

So, if you are buying local it is also important to think about flowers that are grown in-season.

Water Use

A single rose grown in Kenya takes ten litres of water to produce. So, the water footprint of a flower is relatively small (Quick reminder that a 6oz. steak has a water footprint of 2,551 litres).

However, some flower farms are more water efficient than others. And it can matter whether the flower farm is located somewhere that already struggles with water scarcity. Flower farms can impact local communities through water diversion for irrigation and water pollution.

Because of water scarcity in Kenya, the cut flower industry’s water use is a big issue there, for example. Flower producers in Kenya have been connected to pollution in water bodies like Lake Naivasha.

Pesticide Use

As discussed above, the flower industry uses a lot of pesticides. In addition to being a hazard to workers, pesticide use can pollute nearby freshwater and, in some cases, create ocean dead zones.

A study commissioned by Fairtrade International found that Dutch flower producers used less pesticides than Kenyan producers. But among Kenyan producers, fairtrade certified producers in Kenya used fewer pesticides, relative to non-fairtrade producers.

Packaging

Flowers often come wrapped in disposable plastic packaging, which is not ideal. If you can find plastic-free alternatives or buy a bouquet without packaging, do so.

Ethical Certifications

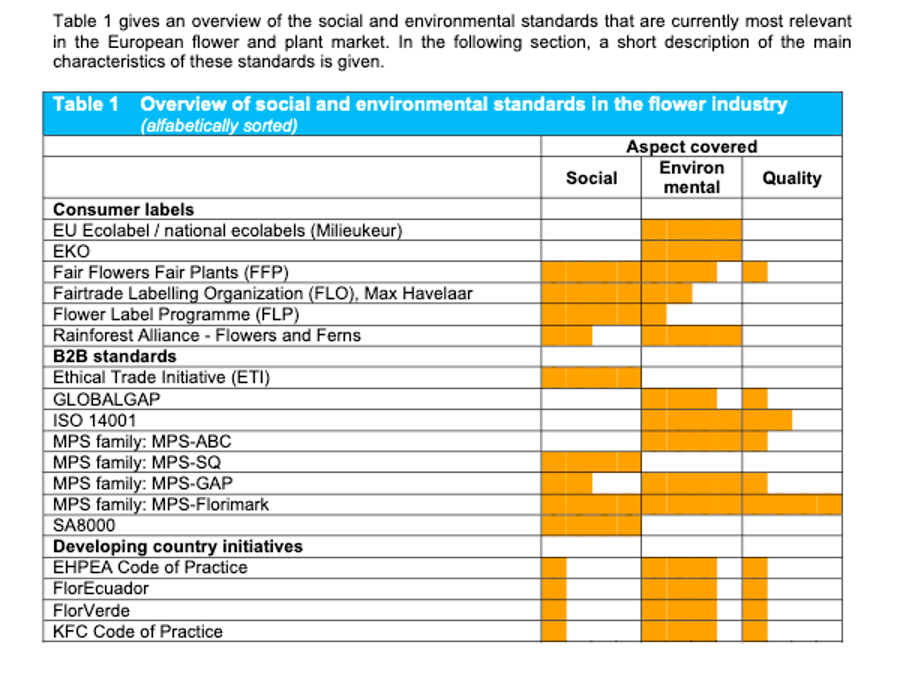

There is a truly overwhelming variety of ethical standards in the cut flower industry. Here is a chart that lists the most relevant standards for European flower and plant buyers:

Describing all of these standards would be challenging. But it is worth highlighting a few.

Organic Certification

Organic certification means that pesticides and other harmful chemicals were not used to grow the flower. There are also some other environmental criteria that may be applied. Different countries have different organic labels.

Fairtrade

We have talked about Fairtrade on the podcast before. See the research note from our sugar episode for a detailed description. Fair trade is a social standard that includes values like decent and safe work, fair prices for producers, and sustainability.

Fairtrade has two different types of standards. One stream is for businesses that hire employees. Another is for smallholders who work in farmer co-operatives.

Rainforest Alliance

Rainforest Alliance is an environmental NGO. Its certification system includes social and environmental criteria.

Developing Country Standards

The four largest developing country flower exporters all have their own ethical labels:

Florverde (Colombia)

FlorEcuador (Ecuador)

KFC Code of Practice (Kenya)

EHPEA Code of Practice (Ethiopia)

Florverde Sustainable Flowers is a social and environmental standard for flower growers in Colombia. It was created based on a code of conduct developed by the Association of Colombian Flower Exporters (Asocolflores). Florverdes includes standards on a number of social and environmental topics, including working conditions, occupational health, sustainability, traceability. Flower growers apply for Florverde certification through independent third party certifiers. As of 2015, 40% of total exports of flowers in Colombia had Florverde certification.

European Standards

There are also a handful of ethical standards developed and used primarily in Europe.

Fair Flowers Fair Plants (FFP) is a consumer label with social and environmental criteria used mostly used by Dutch growers.

The EU Ecolabel is an environmental consumer label that assesses compliance with minimum requirements for sustainability or reduction of harm to the environment.

Flower Label Program (FLP) is a social and environmental certification system mainly in Germany.

Business-to-Business Standards

Some ethical standards are not designed to communicate information to consumers. Instead, business-to-business standards are used by companies that buy a product and apply to companies that produce a product. There are three main sets of business-to-business standards in the flower industry.

The first of these is GLOBALGAP. GLOBAL GAP is a coalition of large European retail chains that defines the elements of “Good Agricultural Practices” (GAP) in areas like crop management, pest control, and worker health and safety. Some other labels (E.g., Florverde) are benchmarked against GLOBALGAP. GLOBALGAP applies to other industries as well. The flower industry standard is the GLOBALGAP Flower and Ornamental Standard.

Next is MPS (“Milieu Project Sierteelt”, which means Floriculture Environmental Project). It was set up as an environmental project by Dutch auctions but now it is active in more than 50 countries. MPS has a series of certificates in different areas. MPS-ABC is the environmental management system, but there is also a social standard (MPS-SQ) and a standard benchmarked against GLOBALGAP (MPS-GAP). Florimark is also a part of MPS and is a certificate for completing certain elements of MPS.

Finally, there is the Ethical Trade Initiative (ETI). ETI is a code of labour practice that focuses on ethical sourcing, used by a coalition of British companies. It is not a certification system, but companies are required to comply with ETI standards. They usually require suppliers to go through a pass/fail audit.

So, How Common is Ethical Certification?

One barrier to certification is low consumer awareness. Only about 10% of consumers are aware that sustainable flowers are available in flower shops. Consumer awareness is highest for Fairtrade.

Consumer awareness may be low, but ethical certification is common in the flower industry. A vast majority of European flower and plant growers participate in one or more certification schemes. “It is not uncommon for African and Latin American producers to hold 5 or more different certificates.” (Trade for Development Centre 2011: p.5)

Certification opens up market segments because some buyers require it. Or it can be a selling feature that differentiates a product or signals quality. For instance, although ethical certification is not required at Dutch auctions, certification through MPS-ABC, FFP, and Florimark are listed at auction.

Generally, certified flowers and plants do not receive higher prices than non-certified products. Certified flowers do go for higher prices at auction, but typically this is due to differences in product quality.

The Slow Flowers Movement

The slow flowers movement encourages consumers to buy flowers grown locally, seasonally, and ethically. Slow also means flowers that are grown “in a considered manner and not rushed through with all sorts of chemicals and artificial interventions.”

What Can You Do?

You can start by looking for flowers that have ethical certification. Ask your local florist or supermarket where they get their flowers! If you are not impressed with the answer, think about finding alternatives. This article from World Vision has a few links to florists that offer fair trade and organic options in Canada.

In general, it is better environmentally to get a potted plant than cut flowers, because they last much longer. For this same reason, you should avoid potted plants that are “designed to die” like poinsettias. Before you buy, Google the plant to ensure that it is not endangered. To get you started, here is an A to Z guide of common house plants.

Endnotes

[1] Business Wars Daily Podcast. (24 February 2021). COVID Ransacked the Cut Flower Industry. Business Wars Daily Podcast episode 653.

[2] Richardson, Courtney. (2014). Love Hurts. Alternatives Journal 40(1): 56-56.

[3] Dundas, Mairead. (7 June 2019). Toxic Cocktail: The Secret Within Your Flowers. France 24 https://www.france24.com/en/20190607-down-earth-pesticides-toxic-chemicals-slow-flowers-bouquets-agriculture-netherlands.